Empower Your Organization: Bagley Risk Management Insights

Just How Livestock Threat Security (LRP) Insurance Policy Can Protect Your Animals Financial Investment

Animals Risk Protection (LRP) insurance coverage stands as a reputable guard against the unpredictable nature of the market, providing a tactical technique to protecting your properties. By delving right into the ins and outs of LRP insurance coverage and its multifaceted benefits, livestock producers can strengthen their financial investments with a layer of safety and security that goes beyond market fluctuations.

Understanding Livestock Threat Defense (LRP) Insurance Coverage

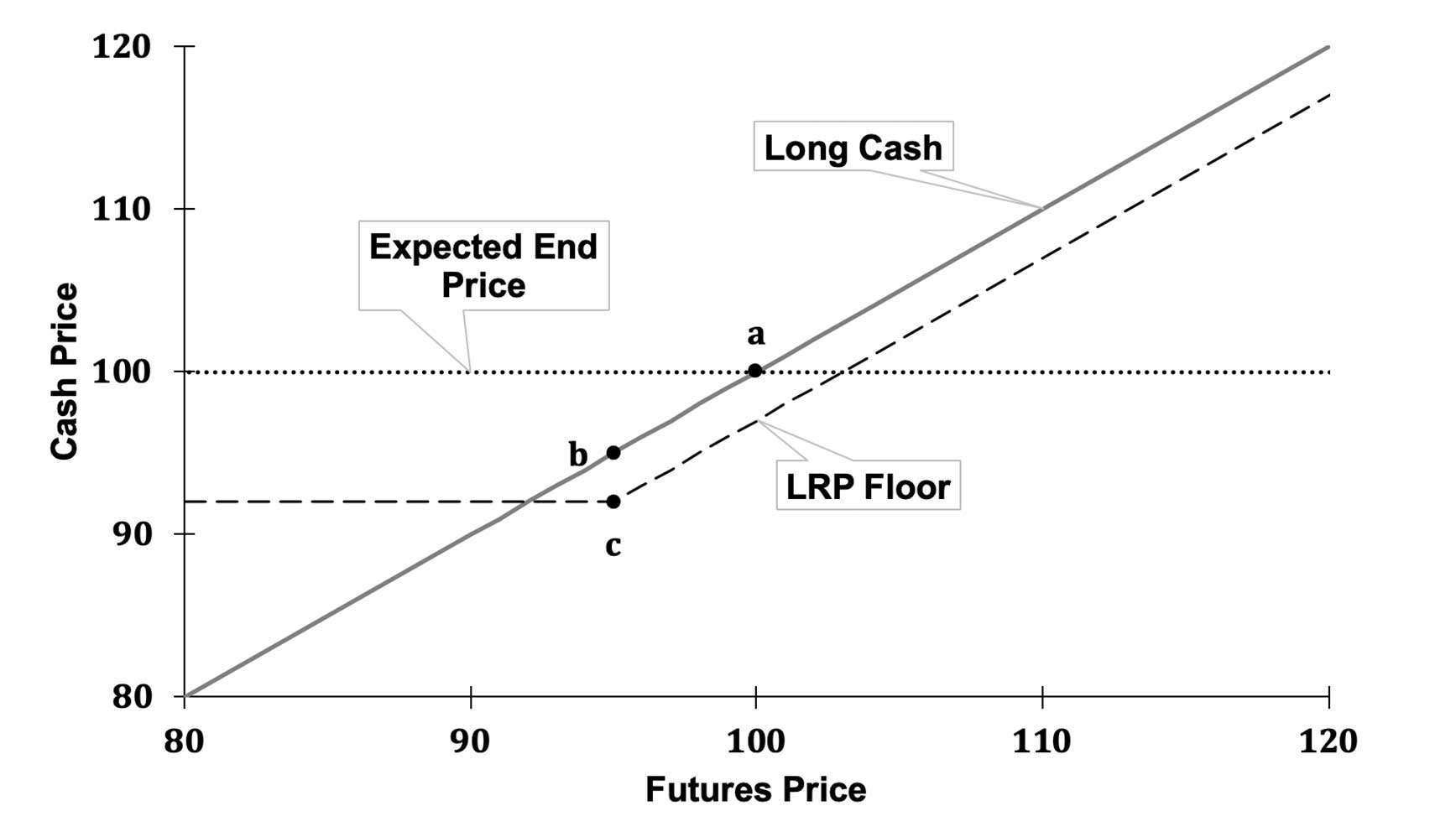

Comprehending Livestock Risk Protection (LRP) Insurance policy is necessary for livestock manufacturers aiming to reduce financial dangers related to price fluctuations. LRP is a government subsidized insurance coverage product made to secure producers versus a drop in market costs. By giving coverage for market price decreases, LRP assists manufacturers lock in a flooring price for their livestock, making certain a minimum degree of income despite market fluctuations.

One trick aspect of LRP is its versatility, allowing producers to tailor insurance coverage levels and plan sizes to suit their particular demands. Manufacturers can select the variety of head, weight variety, insurance coverage rate, and protection duration that align with their production objectives and risk tolerance. Recognizing these adjustable options is critical for producers to successfully handle their price threat direct exposure.

Additionally, LRP is readily available for numerous livestock kinds, including livestock, swine, and lamb, making it a functional danger monitoring device for livestock producers across different fields. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make enlightened choices to guard their investments and make sure monetary security in the face of market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Animals manufacturers leveraging Animals Danger Security (LRP) Insurance acquire a tactical benefit in securing their investments from cost volatility and securing a secure economic ground in the middle of market uncertainties. One essential benefit of LRP Insurance coverage is price protection. By establishing a flooring on the cost of their livestock, manufacturers can mitigate the threat of considerable economic losses in case of market declines. This permits them to intend their budgets better and make notified decisions regarding their operations without the consistent concern of cost fluctuations.

In Addition, LRP Insurance coverage provides producers with satisfaction. Recognizing that their investments are protected against unexpected market adjustments permits manufacturers to concentrate on various other facets of their organization, such as improving pet health and wellness and welfare or enhancing manufacturing processes. This comfort can result in boosted productivity and productivity in the long run, as producers can run with even more self-confidence and security. In general, the advantages of LRP Insurance coverage for animals producers are substantial, offering a valuable tool for taking care of threat and making sure monetary safety and security in an uncertain market environment.

How LRP Insurance Policy Mitigates Market Risks

Reducing market risks, Livestock Risk Defense (LRP) Insurance coverage offers livestock producers with a dependable shield versus price volatility and economic uncertainties. By offering defense versus unexpected price drops, LRP Insurance aids producers safeguard their investments and preserve economic security when faced with market fluctuations. This kind of insurance policy enables animals producers to secure in a rate for their pets at the start of the plan duration, ensuring a minimum rate level no matter market changes.

Steps to Secure Your Animals Investment With LRP

In the realm of agricultural danger monitoring, executing Animals Threat Security (LRP) Insurance coverage includes a critical procedure to guard financial investments versus market changes and unpredictabilities. To safeguard your animals investment properly with LRP, the initial step is to evaluate the particular risks your procedure encounters, such as price volatility or unexpected weather condition occasions. Next off, it is essential to study and pick a credible insurance policy supplier that supplies LRP policies tailored to your animals and business needs.

Long-Term Financial Safety And Security With LRP Insurance Coverage

Making sure withstanding monetary security with the usage of Livestock Risk Protection (LRP) Insurance is a sensible long-lasting approach for farming producers. By integrating LRP Insurance coverage into their risk management strategies, farmers can guard their animals investments against unforeseen market changes and damaging occasions that might jeopardize their economic health gradually.

One key advantage of LRP Insurance coverage for long-lasting monetary security is the assurance it offers. With a trustworthy insurance plan in position, farmers can alleviate the financial threats related to unstable market conditions and unanticipated losses because of factors such as condition break outs or all-natural catastrophes - Bagley Risk Management. This security allows producers to concentrate on the day-to-day operations of their animals company without consistent bother with potential monetary problems

Furthermore, LRP Insurance policy supplies an organized method to taking care of danger over the long-term. By setting details protection degrees and choosing ideal endorsement periods, farmers can tailor their insurance policy plans to straighten with their financial goals and take the chance of tolerance, making sure a sustainable and secure future for their animals operations. Finally, buying LRP Insurance is a positive strategy for farming producers to achieve lasting economic safety and protect their incomes.

Conclusion

In verdict, Livestock Threat Defense (LRP) Insurance policy is a beneficial device for animals manufacturers to minimize market dangers and safeguard their investments. It is a smart option for protecting livestock financial investments.